charitable gift annuity administration

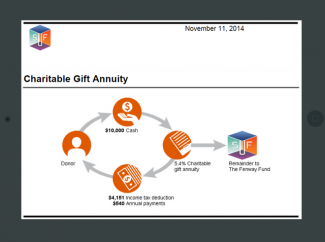

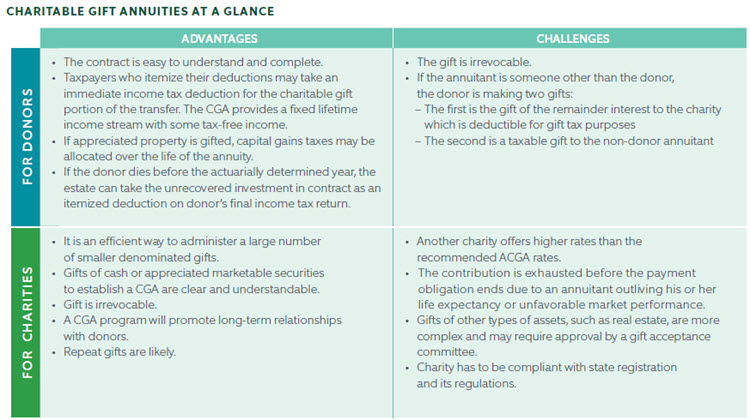

A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization. The administrative aspects of charitable gift annuities can be a burden and obstacle for many smaller not for profit organizations.

What is a charitable gift annuity.

. Charities that offer charitable gift annuities should be aware that many states regulate the issuance of gift annuities. PG Calc makes sure every annuitant receives a check or direct deposit on time and prepares and. Established in 1995 Charitable Trust Administration Company.

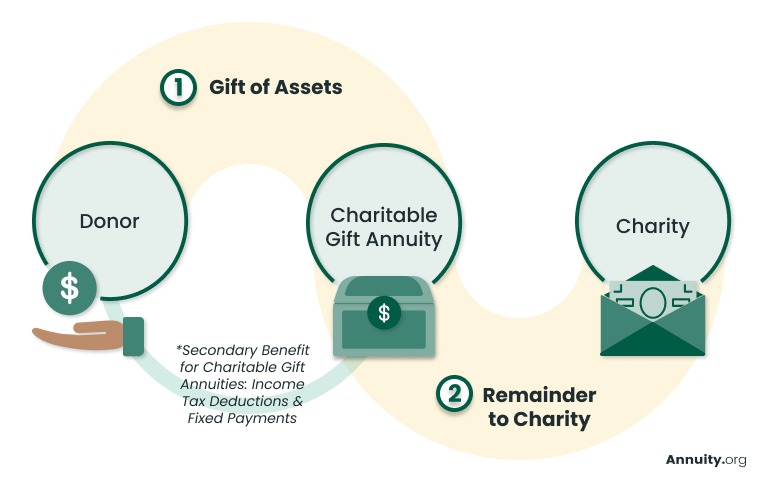

After your death the remainder of your gift is passed. Among the benefits of a Charitable Gift Annuity are. You make the gift part of which is tax deductible and then you receive fixed.

We offer complete administration regardless of the assets utilized to fund the gift. Since 1955 the ACGA has targeted a residuum the amount remaining for the charity at the termination of the annuity of 50 of the original contribution for the gift annuity. A charitable gift annuity is a contract between a donor and a charity with the following terms.

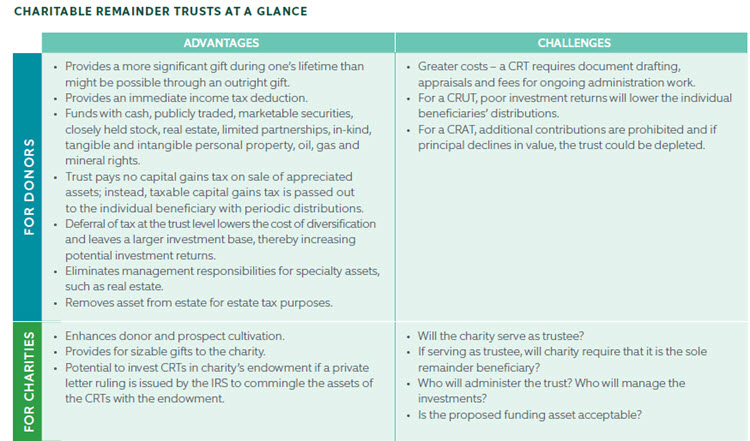

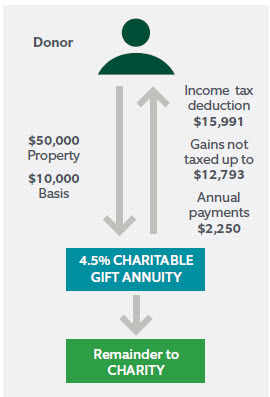

You will receive income for life. As a donor you make a sizable gift to charity using cash securities or possibly other assets. Charitable gift annuities allow donors to make tax deductible contributions to a charitable organization.

Services provided by CTAC primarily focus on planning and administration. A Cambridge-based consulting firm is in discussions with a. In exchange for a gift of assets ie cash stock bonds real estate etc the donor.

Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. Unique in the gift planning community the American Council on Gift Annuities ACGA suggests maximum charitable gift annuity rates monitors state regulations especially as they pertain to. Charitable Solutions LLC in Jacksonville FL administers and works with the National Gift Annuity Foundation NGAF.

Again the value of the IRA at the account holders death in included in the donors gross estate per the IRS but the estate may claim a charitable deduction for the portion. A contract that provides the donor a fixed income stream for life in exchange for a sizeable donation to a charity. We currently administer over 150.

Offering constructive expert administration services to assist you and your donors in managing your philanthropic endeavors. Your rate of return is fixed for life and backed by all the assets of the. The Carter Center works with PG Calc to administer our 270 ish Charitable Gift Annuities.

A CGA delivers fixed income for life immediate tax benefits and a charitable gift to ministry. Meridian St Suite 700 PO. Part of your income may be tax-free.

Michael Carey serves as Vice President of National Gift Annuity Foundation the countrys largest independent charitable gift annuity pool and has extensive experience in charitable estate. We assist in determining an organizations readiness and potential suitability for launching a charitable gift annuity program. Give And Gain With CMC.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. In exchange for the charitable contribution donors. Learn more about our services by reaching out to us today.

A Charitable Gift Annuity CGA with NCF is a simple arrangement that involves a charitable gift and an annuity. Charitable Gift Administration Customized to Your Needs As gift administrators we provide personalized support to our client charities and their donors. Usually regulation is under a states Insurance or.

With a charitable gift annuity you can do both. Earn Lifetime Income Tax Savings. We assist with everything from initial.

We offer deferred flexible and immediate gift annuity structures and the ability to outsource gift annuities.

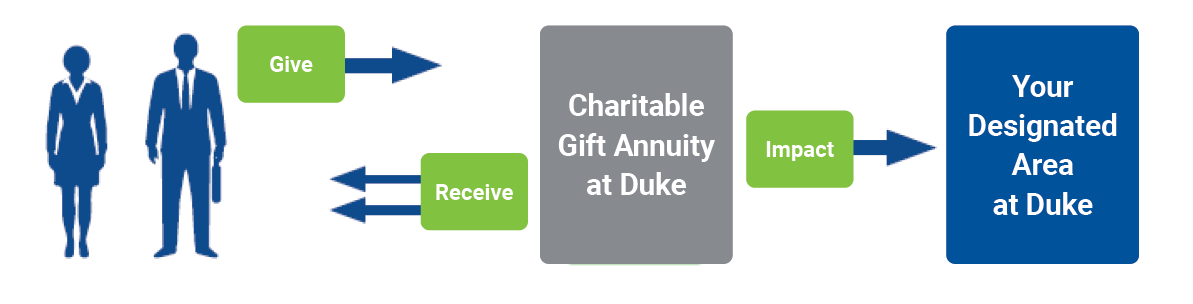

6 Benefits Of A Charitable Gift Annuity Giving To Duke

Charitable Gift Annuities Giving To Duke

Wait Wait Your Wife Is How Old

Income Generating Gifts Harvard Medical School

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

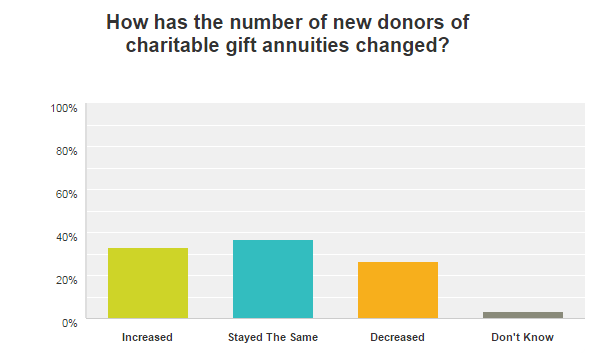

Survey Results How Do You Market Cgas

Charitable Gift Annuities Uses Selling Regulations

4 Long Term Ways To Give To Charity Capstone Financial Advisors

Charitable Gift Annuities Giving To Duke

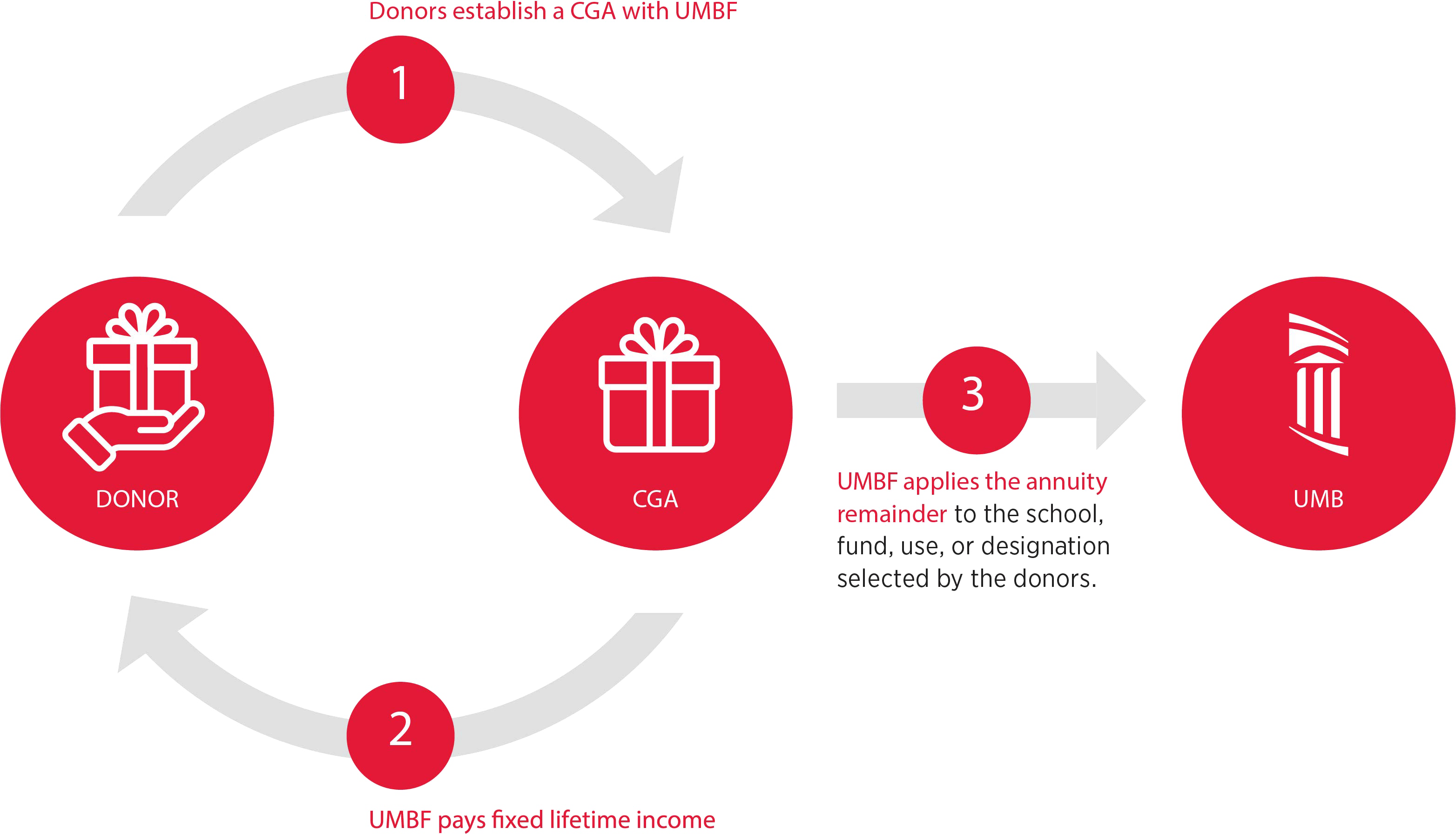

The Umbf Charitable Gift Annuity Planned Giving

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

7 Sponsored Cga Program At Hcf By Hawaii Community Foundation Issuu